This article was first published on the Beauhurst blog.

Data from Beauhurst shows that stakes in the UK’s venture capital and private equity-backed businesses underwent a significant price increase throughout 2020. Prices have now seen a slight correction back towards pre-pandemic levels.

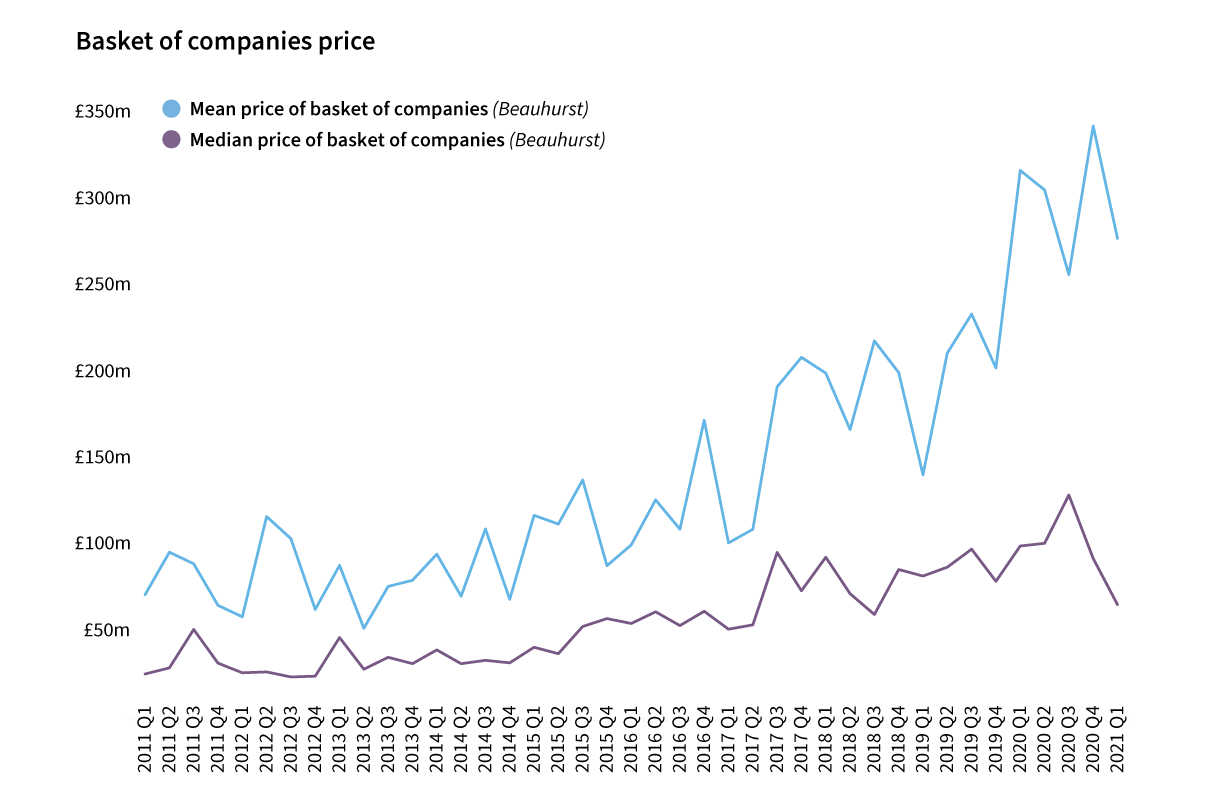

The mean price of a basket of companies based on equity-transaction derived valuations rose by 69% from £203m in Q4 2019 to £343m in Q4 2020. The median price of the basket of companies rose by 63% from £79m in Q4 2019 to a high of £129m in Q3 2020 before falling to £92m in Q4 2020. This increase in price for new shares across the seed, venture and growth stages of the asset class is likely due to a confluence of factors: a record amount of investment into private companies; a global trend towards larger fund sizes; and the Bank of England’s changes to monetary policy to cushion the impact of the pandemic.

While an earlier version of this analysis published in The Deal predicted a continued increase in the price of stakes in private companies throughout 2021, data from the first quarter of 2021 suggests that prices have cooled slightly. The mean price for our hypothetical basket of companies has dropped 19% from Q4 2020 to £278m in Q1 2021, while the median price has dropped 29% over the same period. Although, as is clear in the charts below, the market for new shares experiences significant price volatility.

Source: Beauhurst

This article breaks down the methodology that has been used to calculate the changes in mean and median price over time and explores several potential contributing factors before outlining practical considerations for business leaders and investors. Leaders should seek out transactions at comparable companies to make sure they are getting valued at market rates. Investors are likely to have already noticed that they are paying more than they have previously; the influx of money into the asset class (and tech companies in particular) is also likely to have driven price-based competition. This is unlikely to go away any time soon.

Measuring company valuations over time

To analyse prices changes over time, the cost of a group of nine ‘average’ companies was calculated for the end of each quarter since 2011. The price of the companies has been calculated using both the mean and median company valuation by stage of evolution and sector over the quarter, based on equity fundraisings. Every quarter, the basket of companies consisted of an average-valued seed, venture and growth stage company in the technology, business and professional services, and industrial sectors. These sectors were chosen because they represent 88% of the total number of equity deals since 2011. Beauhurst has deep data on companies that have fundraised at the three growth stages selected, helping to ensure accurate pricing of the basket. This methodology—using a basket of ‘goods’—is also employed to calculate inflation.

Increased investment into the UK’s private companies

There was significant investment of £14.5b into the UK’s private companies in 2020, down slightly from the high of 2019, when £16.3b was invested. However, the full impact of the Future Fund is not yet accounted for in 2020, and the overall investment into UK private business may have been higher. Regardless of this, the rough trend since 2017 has been high annual investment in private companies via a declining number of deals. The first quarter of 2021 saw a record £6.4b invested, beating the previous quarterly record of £4.7b in Q2 2019. Naturally, as more money seeks fewer deals, valuations will rise.

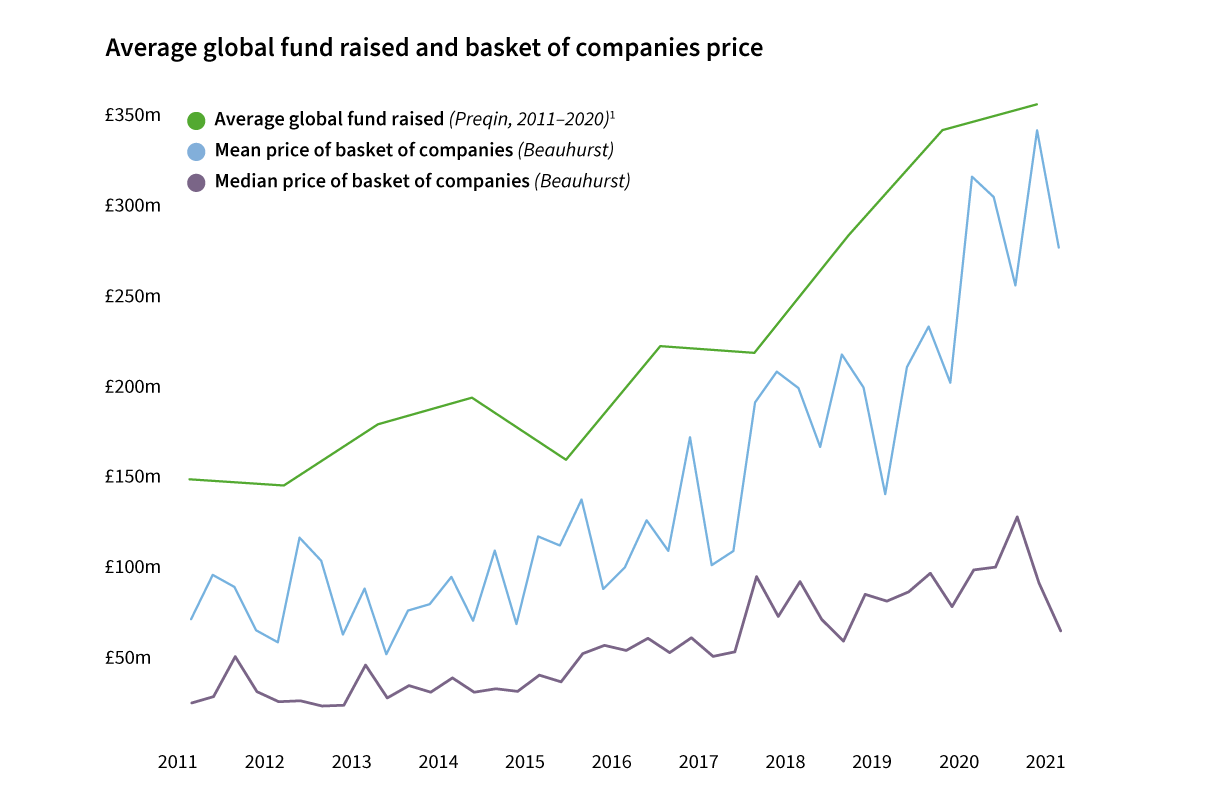

Larger fund sizes

The average fundraising for a fund has increased every year from 2015. In 2015, the average fund raised was £149m, while in 2020, the average fund raised was £361m. The simple argument here is one we’ve heard before; a rising tide lifts all boats. More money for investments means prices will rise. Another subtler aspect may be that, as investors raise larger funds, it becomes more challenging from an administrative and behavioural standpoint to write smaller cheques. Even when investing in smaller companies than usual, a fund manager or VC may find it easier to agree to higher valuations and cut familiar-sized cheques.

With an effect like this in place, valuations for earlier rounds are shifted upwards, which then drives up valuations at later stages.

Source: Beauhurst

In the accompanying chart, the global average fund fundraising has been plotted alongside the price of the basket of companies. Increases in the size of the average fund raised by year match up with increases in the quarterly price of the basket.

This suggests that some of the increase in private company prices in 2020 was probably driven by investors’ successful fundraising efforts in the 2018 and 2019 period, when the average fund raised increased by 56% from £218m to £339m.

Because fund managers have accepted a mandate to invest their limited partners’ money and derive their own income from doing so, it is hard for them to hold back from investing, even during a pandemic. So the large funds raised over the last couple of years have likely been deployed throughout 2020 but into a smaller number of companies that are ‘promising’ in pandemic conditions, again driving up valuations.

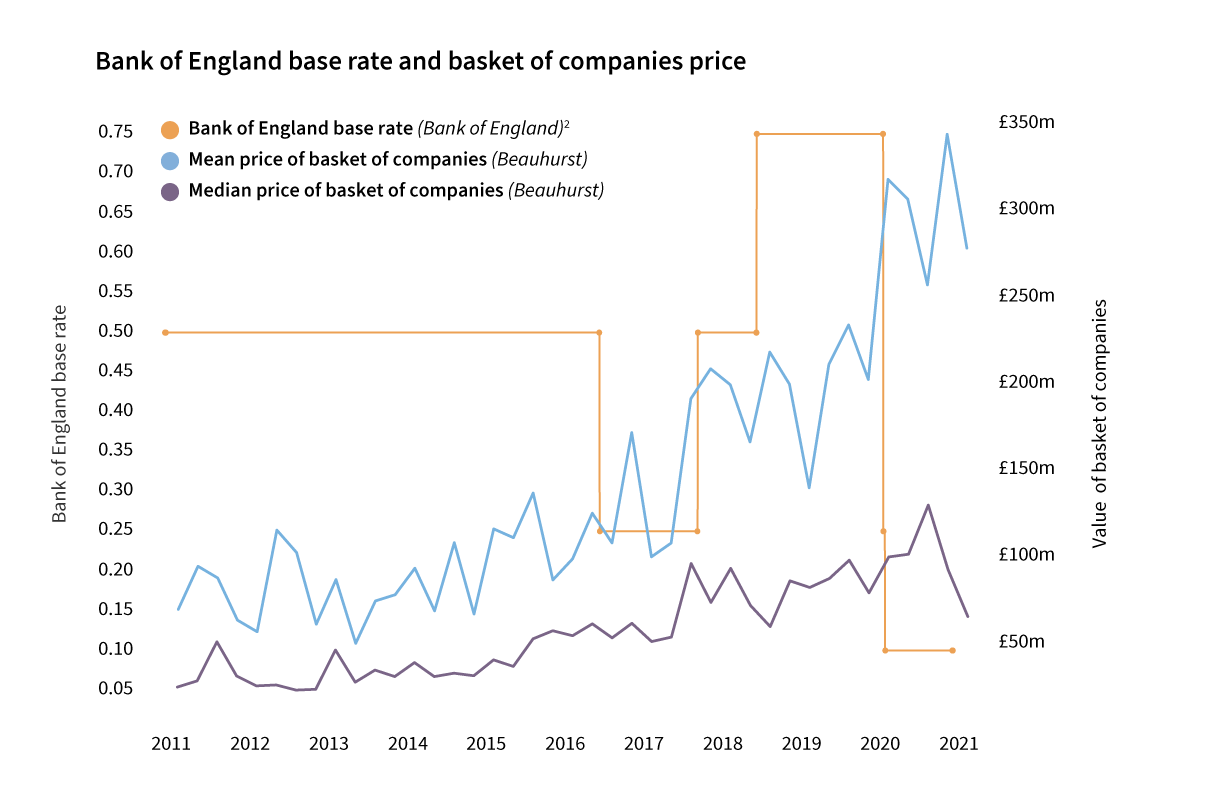

Changes to monetary policy

The base rate chart shows the price of the nine hypothetical companies from Q1 2011 to Q1 2021, overlaid with the Bank of England’s official base rate. This rate impacts how much it costs to borrow money. When rates are low, investors pursue riskier asset classes (such as venture capital) to achieve returns. With more money flooding into private equity assets, prices start to rise. As can be seen, rate cuts in 2016 to curb the impact of the Brexit vote, and in 2020 to cushion the impact of coronavirus, line up with price increases in the basket of companies.

Source: Beauhurst

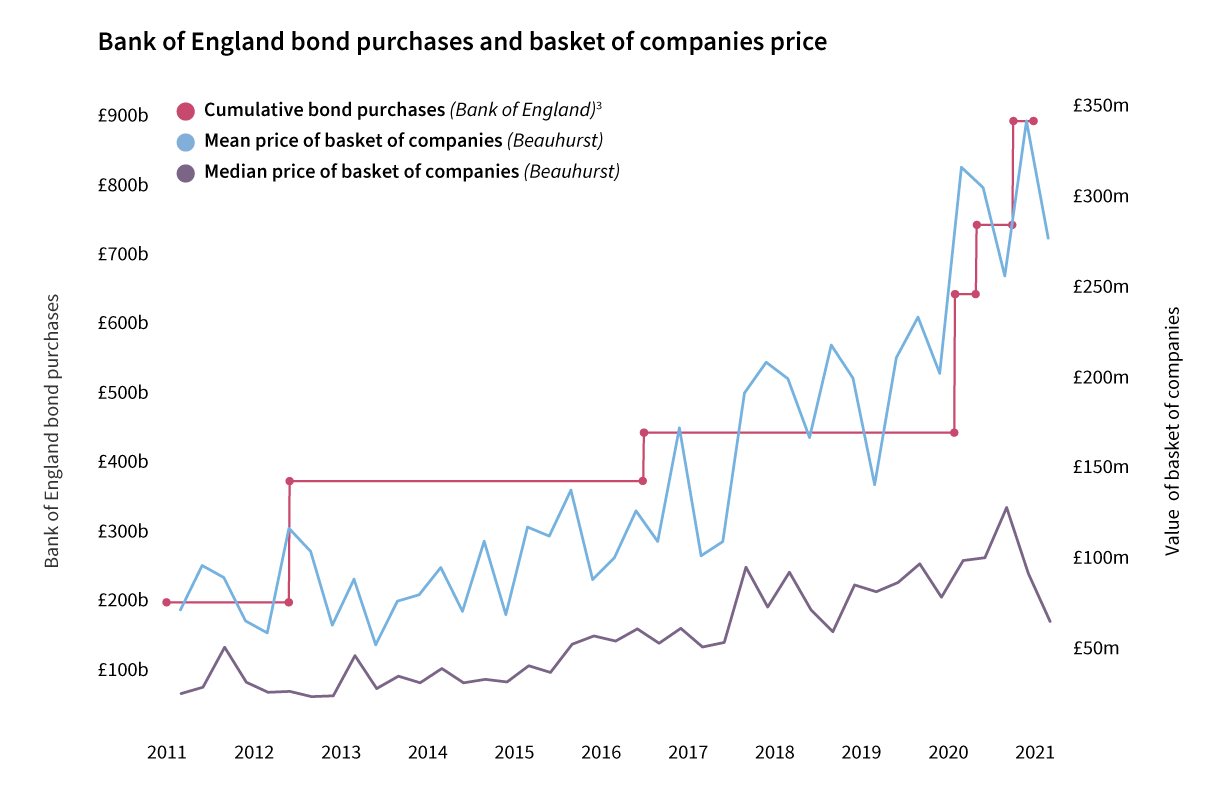

The other part of the story is quantitative easing. Because base rates have been low since the financial crisis of 2008, there was only so much lower that the Bank of England could go, and this alone was not guaranteed to provide the necessary economic stimulus. So, the Bank of England created more money. To do this, it buys billions of pounds of government bonds, which gives investors cash which can then be invested into other financial assets, boosting the value of assets overall. Quantitative easing also fits with the increases in the price of private equity assets.

Source: Beauhurst

The bond purchase chart shows cumulative Bank of England bond purchases against the basket of companies. Where no purchases occur, and the rates are stable or increase, the price of the basket remains relatively steady. This was the case in 2018 and 2019. Where cuts in the base rate coincide with bond purchases, the impact on the basket is more extreme, as was the case after the Brexit referendum and during 2020. Given the scale of the Bank of England’s interventions in the face of the pandemic, we may see further increases in the price of stakes in private companies, despite the decline seen in the first quarter of 2021.

What does this mean?

For founders and business leaders, the increase in the price of equity stakes means that now may be a good time to raise investment. While prices have backed off slightly from the highs of 2020, companies that meet the hurdles for equity finance may be able to secure it on favourable terms. Those raising money should identify recent comparable transactions to use as evidence in discussions with investors.

For investors, the picture is obviously less rosy. Not only are companies more expensive but there are more investors with more money competing for fewer deals—and driving further price increases. Venture capitalists are increasingly competing on factors other than just access to capital. Famous US VC Andreessen Horowitz is something of a bellwether in this respect; it has just launched a media brand called Future dedicated to “rational optimism”. In an inflationary environment, brand, insights and ideology are all potential tools for winning over founders.